5 Investment Market Truths

1. The Current Economic Environment Matters

The economy does not operate in a constant, stable environment. Instead, it moves through distinct regimes such as reflation, inflation, stagnation, and deflation. Each regime rewards different types of assets.

2025 Q4 Investment Outlook

At Client First Capital, our investment approach centers on three critical variables: growth, inflation, and policy. By tracking the rate of change between growth and inflation, we position portfolios to target the best possible risk-adjusted returns. Below, we break down each factor and how it informs our current positioning.

Your 401(k) Could Be Changing—Here’s What Trump’s Order Means

Would you ever imagine holding cryptocurrency, private equity, or real estate inside your 401(k)? For decades, those kinds of investments were off-limits to the average retirement saver. But now, that possibility may be closer than you think.

Building a Retirement Portfolio: What Every Investor Should Know

In the years leading up to retirement, your investment strategy may have been focused on accumulation, maximizing growth, taking calculated risks, and riding out market volatility. But as you enter or approach retirement, the strategy must evolve. Now, it’s not just about growing your assets; it’s about preserving what you’ve built, generating income, and ensuring your portfolio supports a lifestyle that could last 25 to 30 years or more.

Whether you’re five years away from retirement or already there, building a durable and strategic retirement portfolio is essential. Here’s what every investor should know.

Diversifying Your Portfolio After Retirement

In the years leading up to retirement, you may have relied on the simplicity of target-date funds or asset allocation strategies designed to reduce risk as your retirement date approached. Now what? You’ve crossed that milestone—but retirement isn’t the finish line. You still have many years ahead, and you need your portfolio to perform well while continuing to manage risk. That’s where intentional diversification becomes critical.

4th Quarter Investment Planning Outlook

Before diving into the 4th quarter outlook, let's emphasize the importance of building a robust investment portfolio that guards against various risks. Our strategy actively addresses risks such as equity, interest rates, currency fluctuations, liquidity, credit, inflation, foreign investments, time horizons, and economic downturns.

Mid-year Investment Outlook: Navigating 2023 and Beyond

As we step into the latter half of 2023, it's crucial to grasp the evolving dynamics between the economy and the market. In this mid-year investment outlook, we delve into the key occurrences of the past six months and shed light on the potential paths that lie ahead for your investments.

Navigating Q2 2023: Investment Planning in a Shifting Economic Landscape

Key takeaways:

1. Reiterating: Profit-based recession is likely with major credit events

2. Reiterating: Risk of recession > risk of inflation

3. Reiterating: Fed pivot unlikely

It’s been an eventful start to this year. We have already had the 2nd and 3rd largest bank collapses of all time. The CPI calculation has changed for the first time in years. Mortgage rates hit 7.1% for the first time since 1993, and we are only three months into 2023. It’s only April and 2023 is already a year that will be remembered.

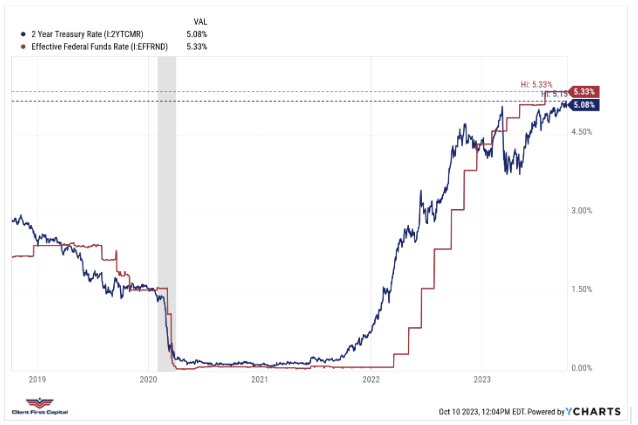

Top 3 Retirement Planning Lessons from Silicon Valley Bank

Well, it’s hard to hide from the news of the Fed and Treasury coming to the rescue of depositors of a failing bank. Silicon Valley Bank is the 20th largest bank in the United States of America and mainly serves the needs of startups and venture capital firms. And because of mismanaged risk and the inability to create liquidity when needed, the bank was taken over by regulators from the FDIC last Friday. This article covers the events that led to the failure of the bank and broader impacts as well as lessons learned from these series of events that can be applied to managing retirement.