Small Business Owners - When Your Business Is Your Estate

Thirty years ago, Tom Walker finished law school and realized that he hated the legal profession. So, with all of the money and time he had invested in his legal degree, he did the next best thing: he opened a restaurant with his older sister Tammy. Armed with their grandmother’s special recipes and sauces, it was no surprise that their endeavor flourished successfully. Over time, the siblings expanded from one location to six, offering what was arguably the best seafood dishes in the city. They weren’t trying to build a fast-food empire, they were just trying to make a living doing what they loved. Fortunately for them, their hard work (and Grandma’s help) paid off handsomely. Both siblings have managed to accumulate a fair amount of assets as well. They have led enjoyable lives and their company has taken on a life of its own. Recently, Tom began to consider the future of the company. While reading his local newspaper, he noticed a recent article raving about the “legendary food” offered at his restaurants, and how it has become an “essential part” of the city. He is now wondering how long the company will be able to provide those dishes. While he is confident about the product they deliver, Tammy’s recent health scare has him concerned about the future.

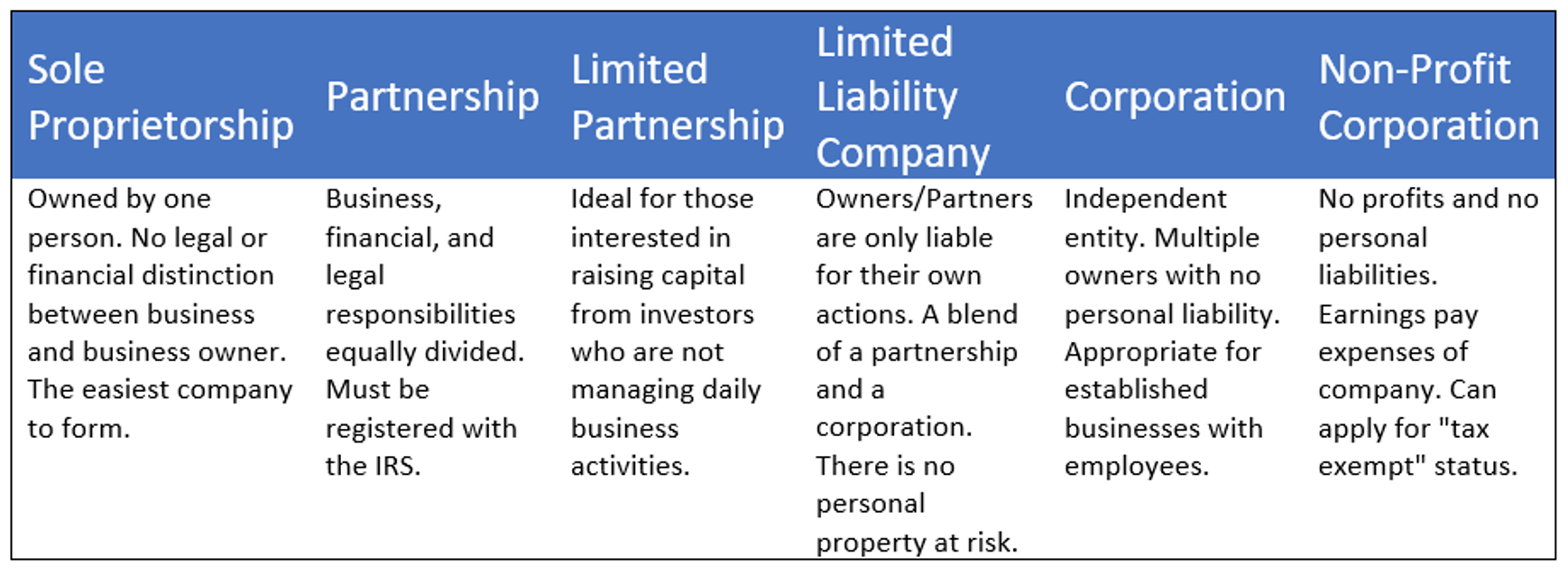

One great feature of his business is the fact that they initially chose a company structure type that was most appropriate for what they were trying to accomplish at the time. Forming the correct company structure can affect future taxes as well as any liabilities or lawsuits incurred during the business. Below is an example of the basic company structures here in the US:

Their choice of a Limited Liability Company (LLC) was beneficial in that it limited the personal liability of Tom, his sister, and their few investors. It also allowed for certain tax breaks initially, since they were able to pass-thru business earnings to their personal tax base. The downside is that it now requires a bit more planning to transfer ownership in the event of death or retirement. Tom has realized this and when he met with his advisor to start estate planning, he realized that over 80% of his assets are his business assets and earnings. Also, he owns 50% of the enterprise. During the meeting, a few points common to most owners of privately held companies came to light:

a.) He and his sister each own 50% of the business. As the business is a Limited Liability Company (LLC) instead of a Corporation, the company’s future will be in question should either of them pass away.

b.) Over 80% of his assets and wealth are wrapped up in the company. How does he transfer his wealth to his family without terminating the company? How can his heirs avoid estate taxes and keep most of their inheritance?

c.) How can these assets help provide income through retirement? Does he even get to retire?

Unfortunately, these are common problems for most small business owners. Many entrepreneurs do not have an exit strategy and, as a result, never fully retire or enjoy the fruits of their labor. Countless successful, privately held businesses have been abruptly terminated upon the untimely death of a partner or essential employee. The good news is that with enough foresight, a proper succession strategy can be planned. When you have a few partners in a company that is not structured as a corporation, a few choices can be made.

To determine a succession strategy, the first step is to examine the company structure and determine the best course of ownership transfer. The second step involves a process to value the business. This usually requires an appraiser and an accountant, since there is more than one valuation method from which to choose. Although this step can be quite costly, it is essential for assessing the value of your assets as retirement and estate planning is very difficult without some form of valuation. Needless to say, it is definitely worth the cost. Once the company is valued, the ability to transfer ownership becomes more realistic. This is essential, particularly for the IRS. Here are a few possibilities that are now possible options for a transfer of assets.

A Cross-Purchase Agreement. This is an option where partners directly purchase ownership from the deceased or exiting partner. Life insurance, loans and savings can be used to fund these transactions.

An Entity Agreement. With this option, the company itself buys the ownership of the departing partner or owner.

Installment Sales is an option that can be designed if an owner wants to step away from the business. This allows for the purchase of the owner’s share by making periodic payments. Providing an income stream to the departing owner over time can provide needed retirement income.

In the case of a Sole Proprietorship or a small partnership, beneficiaries (children, relatives, etc.) can be groomed to inherit and continue the business. While this may be more problematic than partners buying the company (it usually takes 10 to 15 years to groom an heir), it is a viable alternative, particularly when the business is much of a person’s estate. But what if heirs are not interested in running or continuing the business? How can the proceeds be efficiently transferred to heirs without incurring massive estate taxes? Also, how can you ensure enough immediate liquidity to pay off the estate taxes and fees upon death?

If done properly, a Grantor Retained Trust (GRAT) or an Irrevocable Life Insurance Trust (ILIT) are two examples that could provide solutions for these potential issues. Another, more expensive option is to change the registration of the business to a corporation. With this type of company, the business enterprise can continue because the ownership is in the form of more accessible shares. These shares have a value and can more easily be exchanged or “cashed in” in the event of retirement or death. Also, outside investors and/or partners can be more easily obtained to continue the business.

So, what should the takeaway be from all of this? What should you do when planning for retirement or estate planning as a small business owner?

First, take the time to plan for exiting your business and the concept of business continuity. Or, if there is no interest in continuity, a retirement income possibility should be examined.

Second, remember that this is part of your estate and could very well be the bulk of the wealth that you will leave for your loved ones. Thus, this is why the process of estate planning should involve examining the most efficient way to transfer the proceeds of the business to your heirs should you sell or decide to leave.

Third, once all of the buy/sell agreements and other ownership transfer documents have been drafted, and after the strategy has been put in place, remember that things change. Don’t forget to update your wills and your agreements as your business grows and the environment evolves.

Remember, there is no one way to start, run, or transfer a business. Just because you started your company as a partnership or small business doesn’t mean that you cannot change it to an LLC or even a corporation. As your business progresses and becomes more complex, you should adjust accordingly. If you have questions or concerns about successfully transitioning your small business assets, if you are doubting if you are on the correct path, or whether you are wondering if “it’s too late”, we can help! Contact me through our website or call us at 1-800-310-2828. We can help you create a plan for these times!